Ceci est une ancienne révision du document !

Enter my expense reports

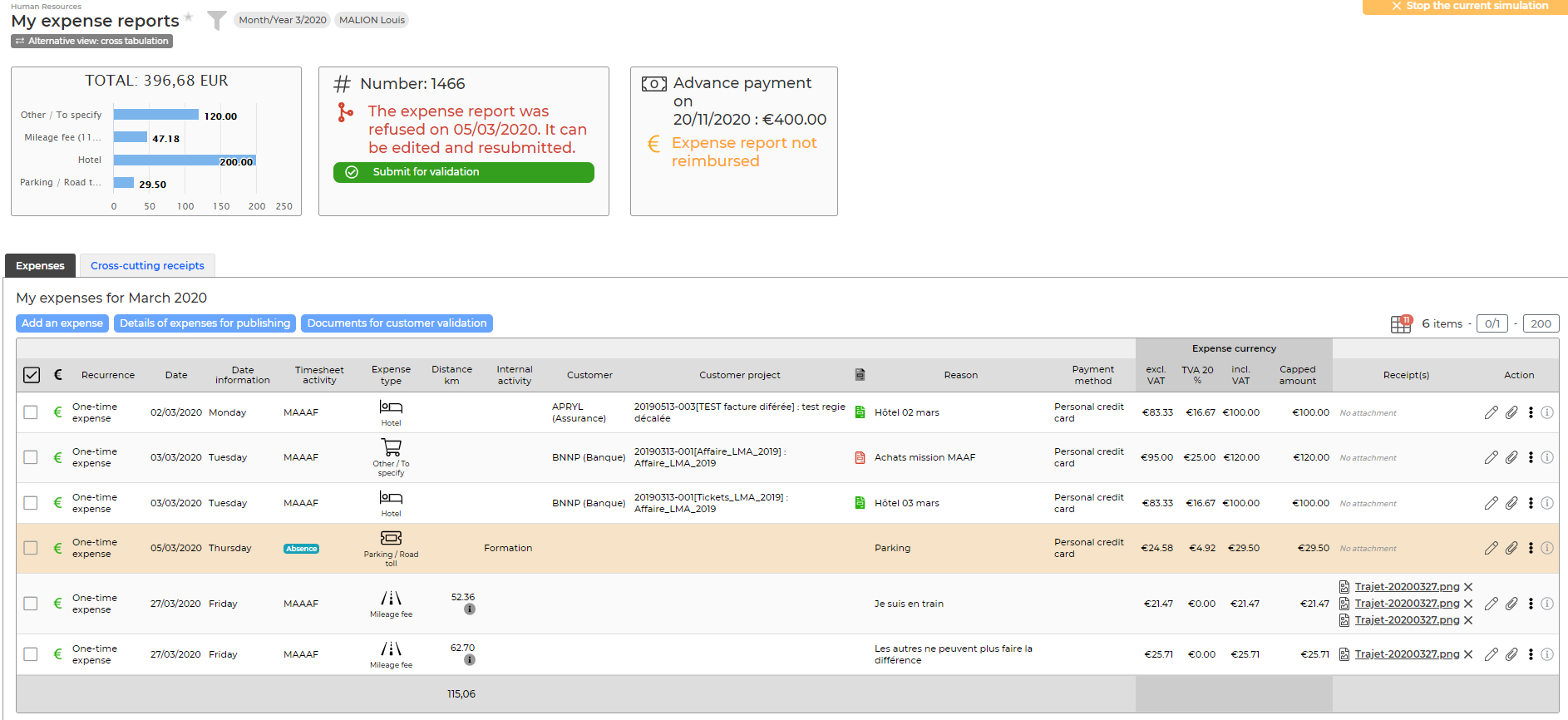

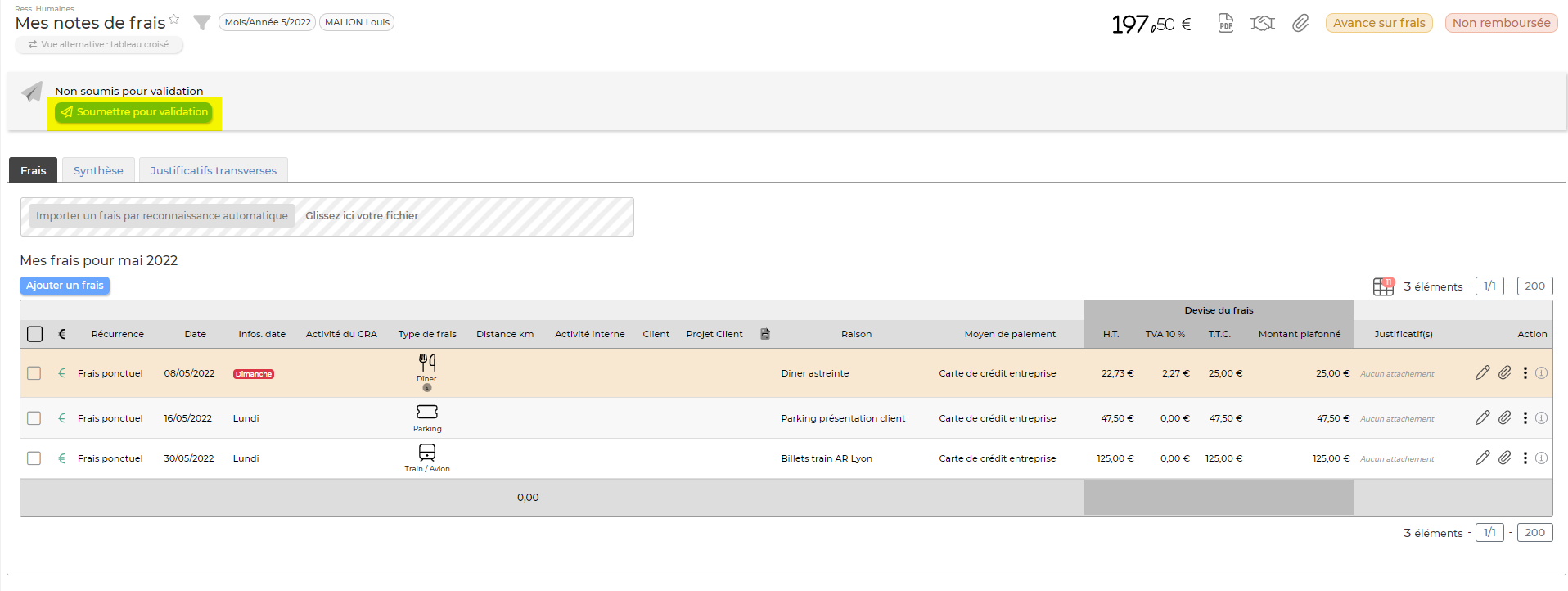

You can declare your expense reports the Human resources > My expense reports menu.

Start by checking the entry month using the filter at the top of the screen. Indeed, if you make your entry at the beginning of the month, for the previous month, it will be necessary to select it just before starting your expense report.

The screen consists of three parts :

- boxes presenting: the summary of your costs, the status of the validation workflow, reimbursement informations

- The list of declared costs

- The list of cross-cutting receipts

IMPORTANT : Yous fees can only be submitted for validation once a month.

Fees declaration

List actions

Global actions

Actions on each row

Edit the expense

Edit the expense

Allows yout o modify a charge after the initial entry.

Attach documents

Attach documents

Allows you to attach the proper receipt to the expense.

From this pictogram you can perform several actions :

- Delete the expense

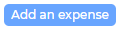

Add an expense

- Choose if the fee is recurring monthly or not (checkbox)

- If the fee is one-off : choose the date on which the expense was made; it must be on the receipt.

- If the fee is recurring : choose the range of months of application.

- Choose the payment method used.

- Choose the type of expense.

- Amount or kilometers :

- For milage-type charges, indicate the distance and depending on the application settings, choose a vehicle or a vechicle power.

- For other fees, indicate the amount excluding tax, then enter VAT. You can enter several amounts of VAT with different rates by clicking on +. If you only know the amount including VAT, indicate it in the HT zone.

- Indicate the reason of the fee.

- If it is an invitation to the restaurant, check the invitation box and indicate the number of guests at the table.

- If the expense is related to a customer activity, do not forger to choose the customer; this fee may be billed to it.

- Is a customer has been chosen, the fee can be tied even more finely to a case to further facilitate re-invoicing possible of this charge.

- You can add an attachment to each expense line. If this item has personal datas, consider checking the dedicated box.

- Click on the save button to save the expense.

For each expense line, you can download one or more electronic documents justifying the expense. One line expense vouchers are important if your business is invoicing your customer for these fees and they need to produce a proof for each expense. if the proof is well attached, you save a lot of time for the person who does the invoicing.

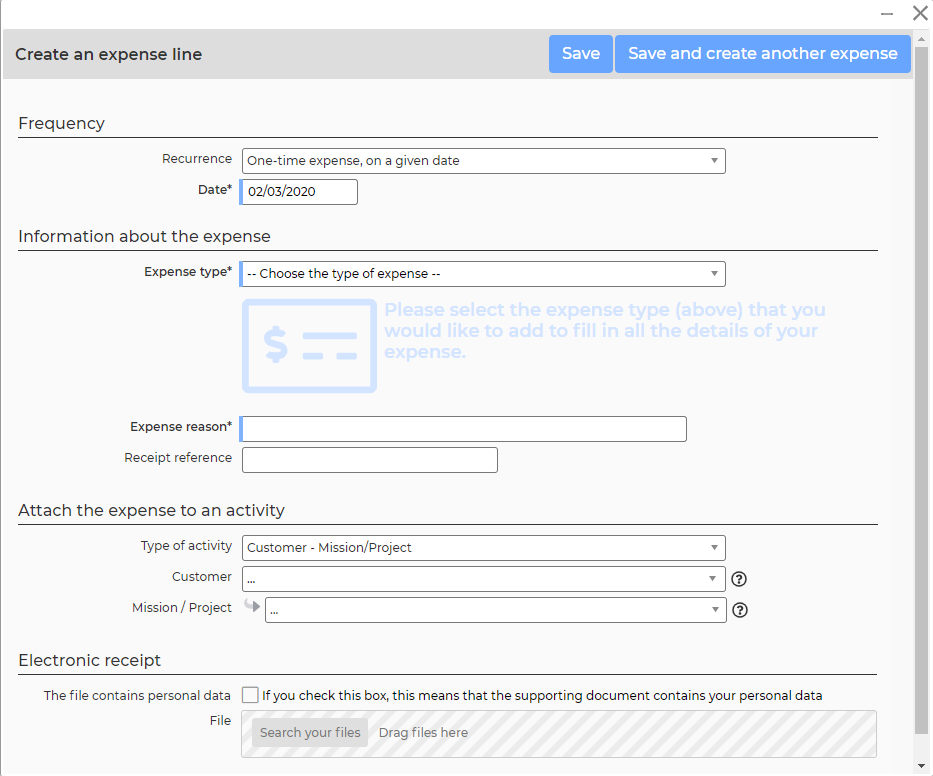

Cross-cutting receipts

You can download one or more electronic documents supporting your expenses. Please note, these documents are transverse to all declare costs..

List actions

Global actions

The window that opens allows you to choose a file, then by clicking on the Attach button, the document downloads to the server and is associated with the expense report.

Use to retrieve the standard document to be printed; on which the supporting documents can be stapled before it is scanned.

Actions on each row

Allows you to retrieve the supporting document that was saved in the application.

Submit your expense request for validation

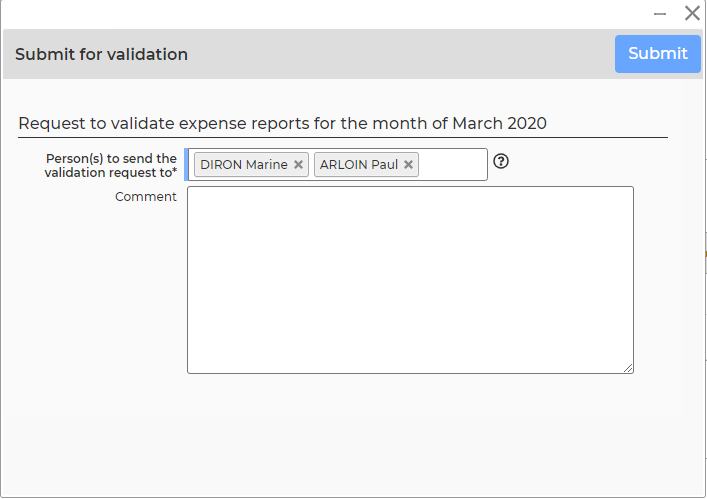

Once your expense have been entered, you must submit them for validation to your manager.

To do this, click on the link  in the box at the top of the screen.

in the box at the top of the screen.

- Choose the manager(s) who should receive your validation request.

- Use the comment box to add any details.

- Click on the Save button to submit your request.

- Your manager will receive an e-mail with th request.

- The progress of the validation is also visible in the box at the top.

- As soon as a workflow update is carreid out by the managern you will receive an e-mail.

- If your manager refuses, you will see the reason ans you will have to adapt your espense report and then submit it at new.